tax avoidance vs tax evasion uk

Estimated that in 201920 the Exchequer loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Tax evasion and avoidance schemes are designed to reduce peoples tax bills and are both viewed negatively by HMRC.

Your Thoughts Tax Avoidance Offshore Loopholes

In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B.

. Understanding how tax evasion and tax avoidance compare is key to avoiding landing yourself in hot water or worse committing a criminal offence. Summary conviction for evaded income tax carries a six-month prison sentence and a fine up to 5000. How serious is tax evasion UK.

BT MA FA LW PM TX FR AA FM SBL SBR SBR AFM APM ATX AAA AAA. Tax evasion is the deliberate non-payment of taxes that is illegal. Basically tax avoidance is legal while tax evasion is not.

One is illegal the other legal though arguably immoral on a larger scale. In recent years tax avoidance has been the subject of considerable public concern although there is no statutory definition of what tax avoidance consists of. Effective tax planning will mean more money in your pocket either for investing or for spending.

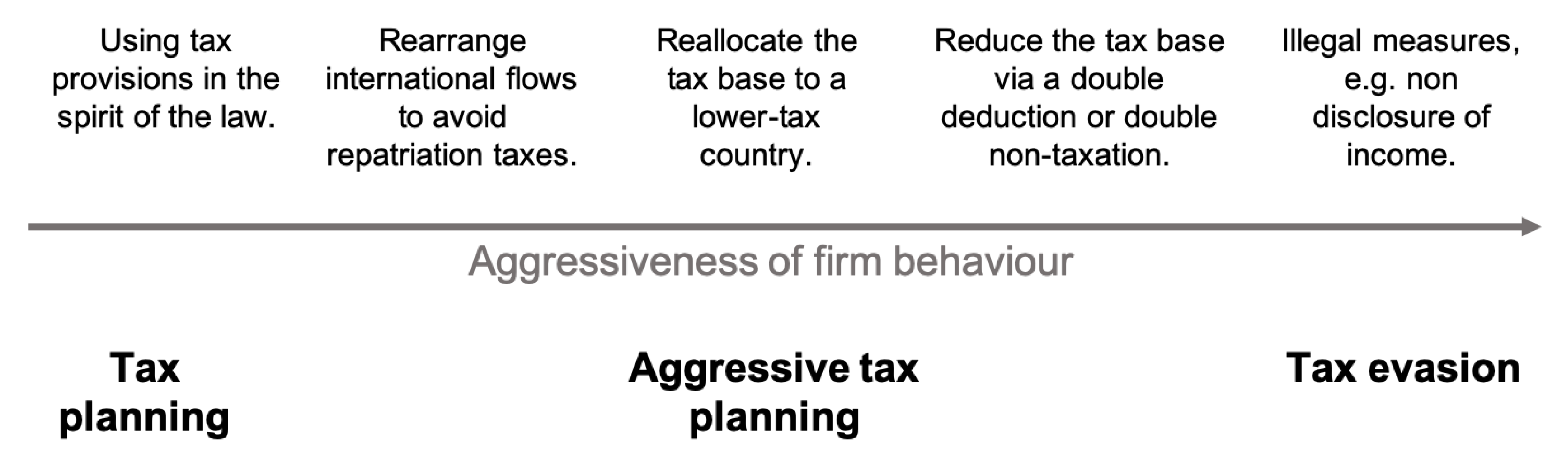

Perhaps we should start with what tax fraud and tax evasion have in common which is that they are both federal crimes. UK Tax System. The difference between tax planning and tax avoidance is that tax avoidance.

Because there is a difference between tax evasion and tax evasion. The difference between tax avoidance and tax evasion is. The difference between tax avoidance and tax evasion essentially comes down to legality.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax avoidance means exploiting legal loopholes to avoid tax. HMRC has confirmed that it has generated billions.

Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts. Tax evasion means concealing income or information from the HMRC and its illegal. Difference Between Tax Evasion and Tax Avoidance.

Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. More serious cases of income tax evasion can result. ACCA TX UK Notes.

Tax Avoidance vs Tax Evasion. Avoiding tax is legal but it is easy for the former to become the latter. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax.

Tax evasion means illegally hiding activities from HMRC to avoid tax. Tax Avoidance And Tax Evasion aCOWtancy Textbook. However the simple difference between the.

Tax avoidance and tax evasion. Tax avoidance is to. Both come with hefty fines as well as the potential.

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Explainer What S The Difference Between Tax Avoidance And Evasion

22 Taxing Quotes On The Good Bad And Evil Of Federal Income Tax

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Vs Tax Evasion Infographic Fincor

Estimating International Tax Evasion By Individuals

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Tax Evasion Vs Benefit Fraud R Ukpolitics

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Businessman Running Away From Tax Tax Refund Tax Debt Restaurant Gift Cards

Tax Avoidance Vs Tax Evasion What S The Difference

The Fraud Triangle Applied To Tax Avoidance Download Scientific Diagram

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post